Money management refers to how a person manages his earnings and expenses to keep track of the money flow. There are several free personal finance software and online tools that make the process of money management easier. This article lists some best free online money management tools or websites. Using these free tools, you can keep track of your daily expenses. Some of these tools also provide a detailed graphical report of your earnings and expenses.

Best free online Money Management tools

We have the following free online money management tools or websites:

- Money Lover

- BudgetTracker

- Budgetpulse

- Goodbudget

- PearBudget

Let’s see the features of all these free tools.

1] Money Lover

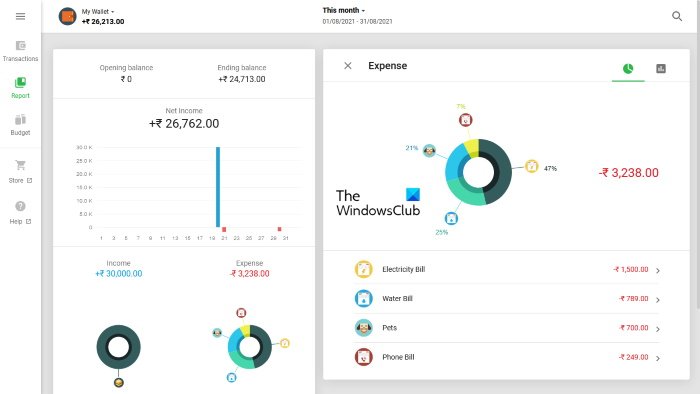

Money Lover is a simple online money management tool that lets you keep a record of your earnings and expenses. The free version of this tool allows you to add only one wallet to your account. If you want to add multiple wallets, you have to purchase their premium version. When you register on the website for the first time, you have to name your wallet, select the currency of your country, and add the initial balance to the wallet. You can also edit these options later in the My Wallets section.

Money Lover has a simple and easy-to-understand interface. Click on the Add Transaction button on the Transactions page. After that, select a category for your expense and enter the amount that you have spent. You can add transactions for the current, previous, and upcoming dates. You can also add a note to each transaction. In the More Details section, you can add location, event, etc., to your transaction. The Future tab lists all the upcoming transactions.

Some features of Money Lover

Let’s explore some of the features of Money Lover:

- Search transaction: This feature lets you search for a particular transaction. You can also apply filters to get more relevant search results.

- You can upload images of your bills and other transactions. The images should be in JPG, JPEG, PNG, and GIF formats and less than 2 MB in size.

- Report: Here, you can view the graphical representation of your income and expenses for the current month, last month, last year, custom date range, etc. It displays the graphical data in pie chart and bar graph formats.

To use this free tool, you have to visit moneylover.me.

2] BudgetTracker

![]()

BudgetTracker is another tool that lets you manage your earnings and expenses online. It is available in both free and paid versions. In the free version, you can add up to 10 bank accounts. By default, it displays all the data in US dollars. You can change this currency in the Settings. The New Currency Symbol option lets you add the currency of your country if it is not available in the list.

To begin, first, you have to add your bank account. For this, go to “My accounts > New account” and fill in the required fields. After adding your bank account, you can add different transactions to BudgetTracker. For every transaction, you can select a particular category. You can also add a new category if the required category is not available in the list. But the free version is limited to only 15 categories. If you want to add more than 15 categories, you have to upgrade your membership.

Some features of BudgetTracker

BudgetTracker offers a number of good features in its free plan. We will list some of these features here.

- My Bills: Here, you can add overdue and upcoming bills. All the bills that you add will be available in the Bills List. In the free plan, you can add up to 10 bills.

- Add income: This feature is beneficial for those who have more than one source of income. The free version of this tool lets you add up to 10 income sources.

- My Budget: If you have any budget plans, you can add them here.

- Kids Budgeting: It is an advanced feature where you can add your kid’s budget plans. But in the free version, you can add only one child to your account.

- Home Inventory: BudgetTracker comes with a free inventory management tool. You can use the Home Inventory section to add the details of your household items.

In the Reporting section, you can view your budget report, income statement, expense report, balance sheet, etc. You cannot print the report summary and view the graphical plot of your income and expenses in the free version.

Visit budgettracker.com to use this free money management tool.

3] Budgetpulse

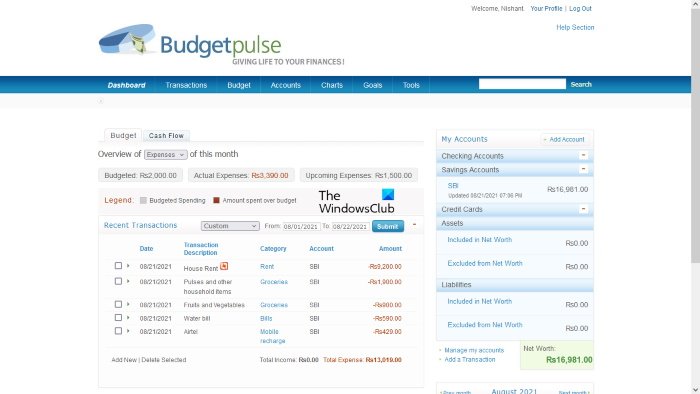

Budgetpulse is one more free online money management tool. US dollar is the default currency in this tool. You can change the default currency in your profile settings. To begin, you have to add your bank account to the Budgetpulse. For this, go to Dashboard and then click on the Add Account button. Similarly, you can also add your Credit Cards, Assets, and Liabilities to your account.

You can add transaction details, new categories, new tags, and amount transfer details in the Transactions tab. There is no pre-added category available in Budgetpulse. You have to create all the categories on your own.

Some features of Budgetpulse

Let’s have a look at some features of Budgetpulse:

- You can add past, current, and upcoming transactions to your account. Apart from that, you can also make any transaction recurring. This option is useful when you have to pay the same amount every month like house rent.

- You can also split and add a note to a particular transaction.

- In the Budget section, you can manage your budget plans.

- Budgetpulse lets you add more than one bank account.

- Export and import options are also available in Budgetpulse. OFX, QFX, QIF, and CSV are the supported file formats to import data. To use these options, click on the Tools tab.

The Charts tab shows a detailed report of your income, expenses, a comparison between your income and expenses, net worth, and account summary. The Export to PDF option is available in the Charts tab, but it did not work for me.

Visit budgetpulse.com to keep a track of your income and expenses.

Read: Manager is a free financial software for small businesses.

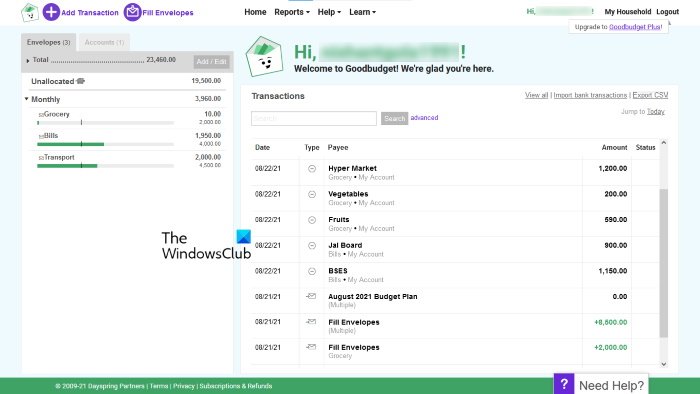

4] Goodbudget

Goodbudget lets you add only one bank account in its free version. There is no option to add currency. It displays your income and expenses only in numerical value without any currency symbol. You can add four different types of transactions in Goodbudget, namely:

- Expense/Credit

- Money transfer

- Income

- Debt transaction

In Goodbudget, you can plan your monthly budget for different categories by adding envelopes. Its free version lets you add up to 10 regular envelopes and 10 more envelopes. The More Envelopes is an advanced section where you can add your budget for every 2 months, 3 months, 6 months, annually, etc.

How to use Goodbudget

Let’s see the process of creating a budget plan in Goodbudget.

- First of all, you have to add your bank account. For this, click on the Accounts tab and then click Add/Edit button. Now, add your bank account name and current balance.

- Now, you have to create some envelopes. For this, go to Home and then click on the Envelopes tab. Now, click on the Add/Edit button to add new envelopes and edit the existing ones. Click on the Add button to create a new envelope. After that, enter the total amount that you want to allocate to that envelope. When you are done, click Save Changes.

- After creating all the envelopes, you have to fill them with the amount that you have allocated. Go to Home and then click Fill Envelopes. In the Fill from section, you can name your budget under the Unallocated tab. In the Fill your envelope section, enter the amount to each envelope equal to the amount allocated to that particular envelope. When you are done, click Save.

- Now, you can add transactions. To do so, go to Home and then click Add Transaction. Fill in all the details and click Save.

In the Reports section, you can view 8 different types of reports, including Spending by Envelope, Spending by Payee, Income vs Spending, Debt Progress, Budget Allocation, etc.

You can import bank account transactions to your Godbudget account. QFX, OFX, and CSV are the supported file formats to upload bank account transactions. Apart from that, the tool also lets you export your transaction data in CSV format.

Visit goodbudget.com to use this free online tool.

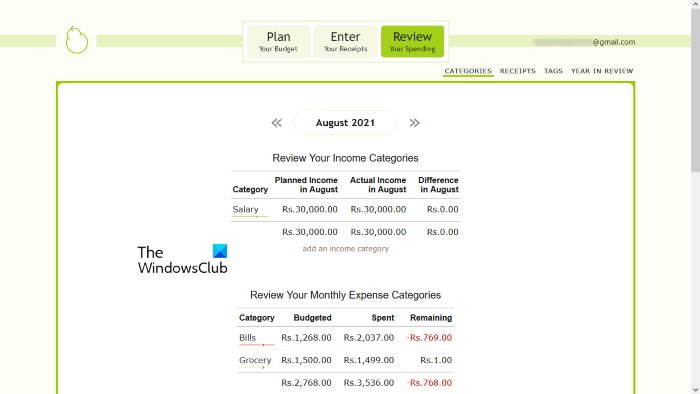

5] PearBudget

PearBudget is a simple money management tool that comes with a few features. Here, you can add your income and expenses, and plan your budgets. By default, it does not display any currency. You can add your country’s currency in your account settings.

Click on the Enter your Receipts section to enter your income and transactions for a particular month. For each transaction, you have to add a category name. You can mark each category name as:

- Monthly (balance doesn’t carry over each month)

- Irregular (balance carries over each month)

- Income

You can also create multiple tags for each category.

You can also plan your budget category-wise. If your expense for a particular category exceeds the set budget, it will be marked with a red color. The Review your Spending section includes a detailed report of your earnings and expenses. Click on the Year in Review tab under this section to view your income and expenses report for a particular month.

The Print report option is also available in PearBudget.

Visit pearbudget.com to manage your money online.

Read: TakeStock 2 is a free Personal Investment Management software.

How can I keep track of my money online?

You can use any online money management website to keep track of your money. We have mentioned some of the free online money management tools in this article. You can register on any of these websites and manage your expenses and earnings for free.

Which app is the best for daily expenses?

If you search, you will find many free personal finance and budgeting apps on Windows Store. These apps provide a detailed analysis of your monthly earnings and expenditure in both numerical and graphical forms. By analyzing your monthly reports, you can plan your budget better.

That’s it.

Read next: Free Personal Finance & Business Accounting Software for Windows.